Rocky’s Weekly Stock Picks

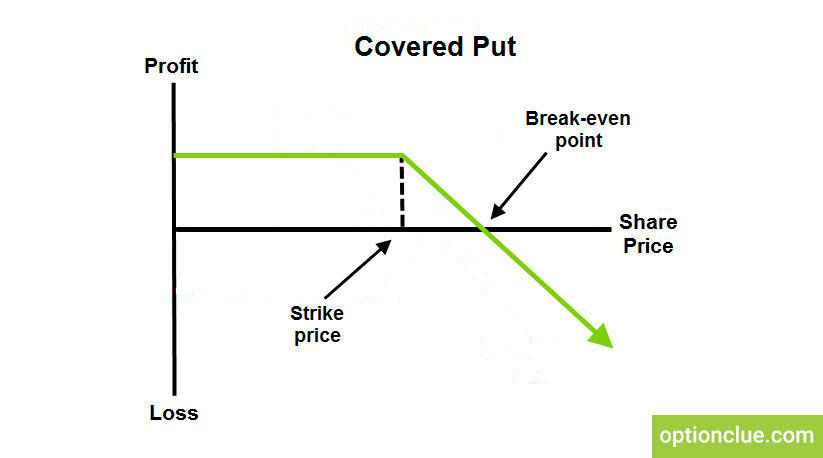

I like that the profit loss arrow is green, because (a few of you already knew where this was going, I bet) for me, the share price staying above the strike price is a win. Allow me to explain…

Just like selling covered calls out of the money to squeeze some instant interest out of your investment, you can squeeze extra interest out of…your..investment. But it’s just liquid cash. Say RIOT is trading at $3.68, and has been in the 3.50+ range for a week or so, and I feel like (because your pretend emotional attachments to ticker symbols are the best way to make investing choices) it needs to get back to its $4.00 norm. I put up $350 upfront, collect a premium of I think it was like $40 tbh, pretty nice as I recall, the price goes up so the option doesn’t get exercised and I get my money back.

What if it gets exercised? What if I have to buy the shares? Guess what, I WANT the shares. I want all the shares. As long as I can keep selling premium on the shares, I’m fine. (The caveat is I want to make sure that either I’ve collected enough premium to recover my initial cost, or at least to cover the cost of the difference between the price I bought it for vs the price I sell it for. And to be honest if you get burned at this point, that’s on you). Whether RIOT multiplies in price (And it will, being the #3 Blockchain company in terms of projected hashrates by sometime in 2021…tbh I just saw the headlines, I already previously concluded that Riot is a company I’m comfortable investing/trading with) or just sits completely flat (ideal for farming premiums), I am happy with my decision.

RIOT - The gift that just keeps on giving. I love this one as much, maybe more, as NAK.

VXRT - So supposedly vaccine stocks are gonna tank despite the good news lately. I can see it. I might gamble on MRNA this week, we’ll see. But VXRT I’m more familiar with and can attest to it being affordably wonky, so no matter what my odds of making at least a few dollars are solid.

CODX - Pretend emotional attachments sometimes pay off. I’m no CODX stock price expert, but this bad lad definitely has a predictable attitude. Tread lightly with short-term options, though. At least until you’re able to daytrade, or else it’ll mess with you.

ROKU - I wish I could afford to play with this more. I was really hoping to hit it big on a super long shot (with UPWK or WKHS). At $230 this is definitely a big boy stock, and I’m just not there yet. Options for real stocks are pretty expensive lol.

SYY - SYY saved the day when I was getting played hard by SBUX. Good things come from Sysco.

I would like to have Workhorse here, since they’re I guess making fleets of electric delivery trucks. And Sysco is converting its delivery fleet to electric. However, I haven’t done so much as a google search to figure out if Sysco will be working with Workhorse or not. EV’s are happening, and they’re happening fast. Ford announced its commitment to electric work vans, and there’s an EV plant being built in Hamtramck. My thought is, the big name automakers aren’t going anywhere even when their models fail, but other companies involved in producing EVs might very well go out of business (especially early on in this new era) if a specific model vehicle is a total flop. But I still don’t have the necessary information to properly decide if there’ll be direct correlation between companies.